COMPANY INFORMATION

Office: (720) 903-1510

Admin@FortunateFamilyOffice.com

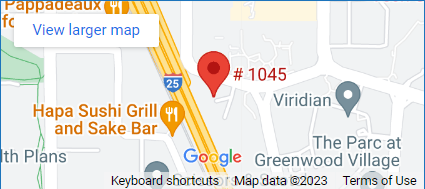

5251 DTC Parkway

Suite 1045

Greenwood Village, CO 80111

SCHEDULE APPOINTMENT

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck

The content is developed from sources believed to provide accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Securities offered through LPL Financial, Member FINRA & SIPC. Investment advice offered through Western Wealth Management, a registered investment advisor. Western Wealth Management and Fortunate Family Office are separate entities from LPL Financial.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Licensed to sell insurance in the following States: CO

FINRA Series 7 for Wade Olson held with LPL Financial. Series 66 for Wade Olson held with Western Wealth Management, LLC.