The U.S. economy’s recovery from the pandemic continues to surpass our expectations, aided by the accelerating vaccine distribution, massive stimulus, and America’s desire to resume some semblance of normal daily life. Despite having raised our 2021 economic and...

The U.S. economy’s recovery from the pandemic continues to surpass our expectations, aided by the accelerating vaccine distribution, massive stimulus, and America’s desire to resume some semblance of normal daily life. Despite having raised our 2021 economic and...

Dear Valued Investor, “The real key to making money in stocks is not to get scared out of them.” Peter Lynch They say April showers bring May flowers. Well, after a lot of showers and storms over the past year, flowers are starting to bloom and things are looking a...

Dear Valued Investor, “The real key to making money in stocks is not to get scared out of them.” Peter Lynch They say April showers bring May flowers. Well, after a lot of showers and storms over the past year, flowers are starting to bloom and things are looking a...

There is a growing debate over whether an expanding economy, in conjunction with historic fiscal and monetary stimulus, may cause inflation to overheat. Adding to the intense debate, the Federal Reserve (Fed) has shifted its policy framework, potentially allowing...

There is a growing debate over whether an expanding economy, in conjunction with historic fiscal and monetary stimulus, may cause inflation to overheat. Adding to the intense debate, the Federal Reserve (Fed) has shifted its policy framework, potentially allowing...

The bear market ended one year ago this week, finishing one of the fastest and most vicious bear markets of all-time—one that led to a drawdown of 34%. Things have come full circle now, as stocks have staged a furious rally, with new highs happening across the globe...

The bear market ended one year ago this week, finishing one of the fastest and most vicious bear markets of all-time—one that led to a drawdown of 34%. Things have come full circle now, as stocks have staged a furious rally, with new highs happening across the globe...

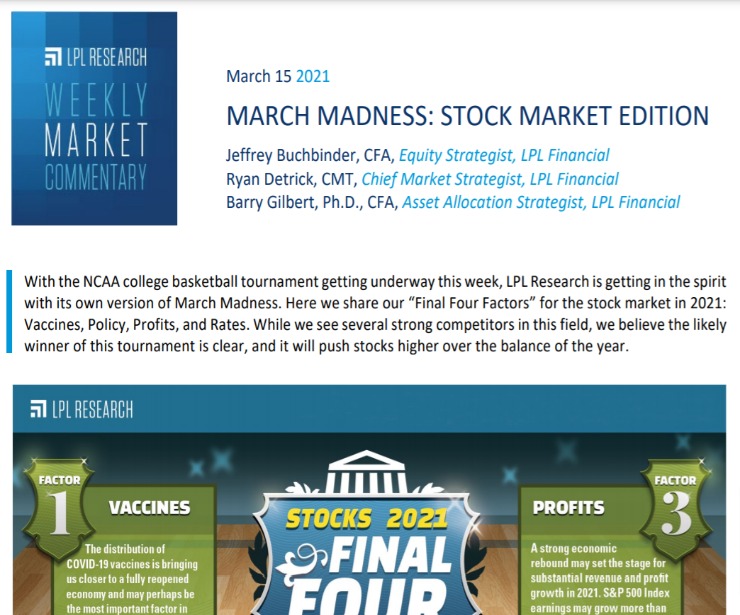

With the NCAA college basketball tournament getting underway this week, LPL Research is getting in the spirit with its own version of March Madness. Here we share our “Final Four Factors” for the stock market in 2021: Vaccines, Policy, Profits, and Rates. While we see...

With the NCAA college basketball tournament getting underway this week, LPL Research is getting in the spirit with its own version of March Madness. Here we share our “Final Four Factors” for the stock market in 2021: Vaccines, Policy, Profits, and Rates. While we see...

Our year-end S&P 500 Index fair value target range remains 4,050–4,100, based on a price-to-earnings (PE) multiple of 21 and our 2022 S&P 500 earnings forecast of $195 per share. Recall that we raised our S&P 500 fair value target last month due to our...

Our year-end S&P 500 Index fair value target range remains 4,050–4,100, based on a price-to-earnings (PE) multiple of 21 and our 2022 S&P 500 earnings forecast of $195 per share. Recall that we raised our S&P 500 fair value target last month due to our...