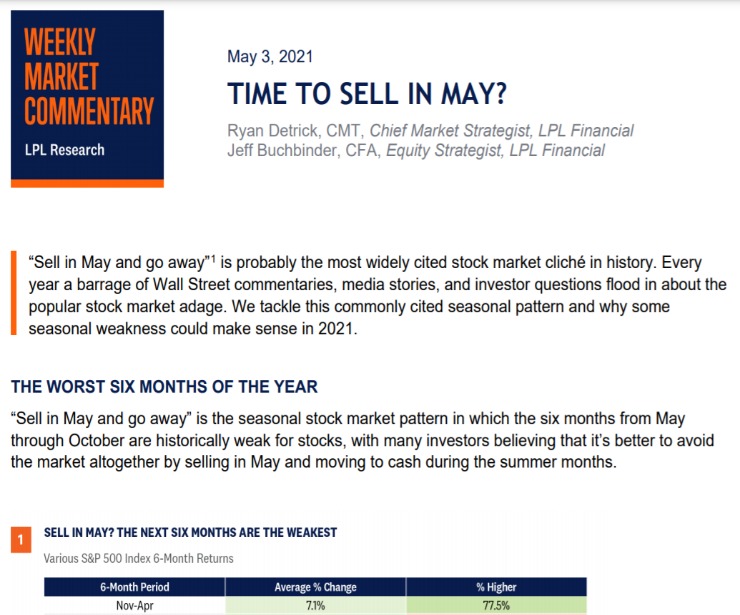

“Sell in May and go away”1 is probably the most widely cited stock market cliché in history. Every year a barrage of Wall Street commentaries, media stories, and investor questions flood in about the popular stock market adage. We tackle this commonly cited seasonal...

“Sell in May and go away”1 is probably the most widely cited stock market cliché in history. Every year a barrage of Wall Street commentaries, media stories, and investor questions flood in about the popular stock market adage. We tackle this commonly cited seasonal...

Last week we discussed whether stock prices might be reflecting peak optimism. In that commentary we noted that while sentiment may be overly optimistic and a pickup in volatility would be totally normal, strong breadth measures suggest stocks still may have more...

Last week we discussed whether stock prices might be reflecting peak optimism. In that commentary we noted that while sentiment may be overly optimistic and a pickup in volatility would be totally normal, strong breadth measures suggest stocks still may have more...

Global stock markets are off to a strong start in 2021 as the world begins to emerge from the shadow of the COVID-19 pandemic. In the United States, vaccinations are increasing, the economy is expanding, unemployment is falling, and stimulus continues to flow through...

Global stock markets are off to a strong start in 2021 as the world begins to emerge from the shadow of the COVID-19 pandemic. In the United States, vaccinations are increasing, the economy is expanding, unemployment is falling, and stimulus continues to flow through...

The outstanding fourth-quarter earnings season we had in 2020 is a tough act to follow, but 2021’s first quarter has the makings of another potentially great earnings season. The reopening of the economy continues to move forward, and corporate America has done an...

The outstanding fourth-quarter earnings season we had in 2020 is a tough act to follow, but 2021’s first quarter has the makings of another potentially great earnings season. The reopening of the economy continues to move forward, and corporate America has done an...

The U.S. economy’s recovery from the pandemic continues to surpass our expectations, aided by the accelerating vaccine distribution, massive stimulus, and America’s desire to resume some semblance of normal daily life. Despite having raised our 2021 economic and...

The U.S. economy’s recovery from the pandemic continues to surpass our expectations, aided by the accelerating vaccine distribution, massive stimulus, and America’s desire to resume some semblance of normal daily life. Despite having raised our 2021 economic and...

There is a growing debate over whether an expanding economy, in conjunction with historic fiscal and monetary stimulus, may cause inflation to overheat. Adding to the intense debate, the Federal Reserve (Fed) has shifted its policy framework, potentially allowing...

There is a growing debate over whether an expanding economy, in conjunction with historic fiscal and monetary stimulus, may cause inflation to overheat. Adding to the intense debate, the Federal Reserve (Fed) has shifted its policy framework, potentially allowing...