Budgets are tricky. If you struggle with managing your own, we’ve got a process to help you save and become aware of your spending habits.

Puzzle Of The Week:

3:43 – If budgets make you want to take a power drill to your foot, we hope to make the budgeting process easier for you. We want to help you save.

Jigsaw Pieces:

5:00– Spend Less Than You Make.

Sounds simple enough, right? When you spend less than you make, you can save and build wealth. However, if you don’t have a system for tracking your spending, you end up poorer with a bunch of junk you don’t need. We’re emotional creatures, and we’ve all been guilty of the occasional impulse purchase. The trick is to develop a system that works for you, and to do that, you need to start by taking inventory of what you’re spending.

You have two tools at your disposal to do this. One is your bank account. The other is your credit card statement. Your credit cards will be especially telling of your spending habits. Start by categorizing your expenditures as essential, non-essential but pleasurable, or waste. See where your money is going and what needs to change.

9:35 – Revise Your Expenses.

First, the waste has got to go. Add up everything you consider to be a wasteful expense, and subtract it from your budget. Next, take half of those non-essential but pleasurable expenses out of your budget. Once you’ve done that, develop your new list of essential and non-essential but pleasurable expenses. Compare that list to your monthly take home pay. Hopefully, once you’ve eliminated the waste, you’ll be able to cut a lot of your spending. Remember, the goal is simply to spend less than you make, and the purpose of this exercise is to show you this is possible in your budget.

10:36 – Track Your Spending.

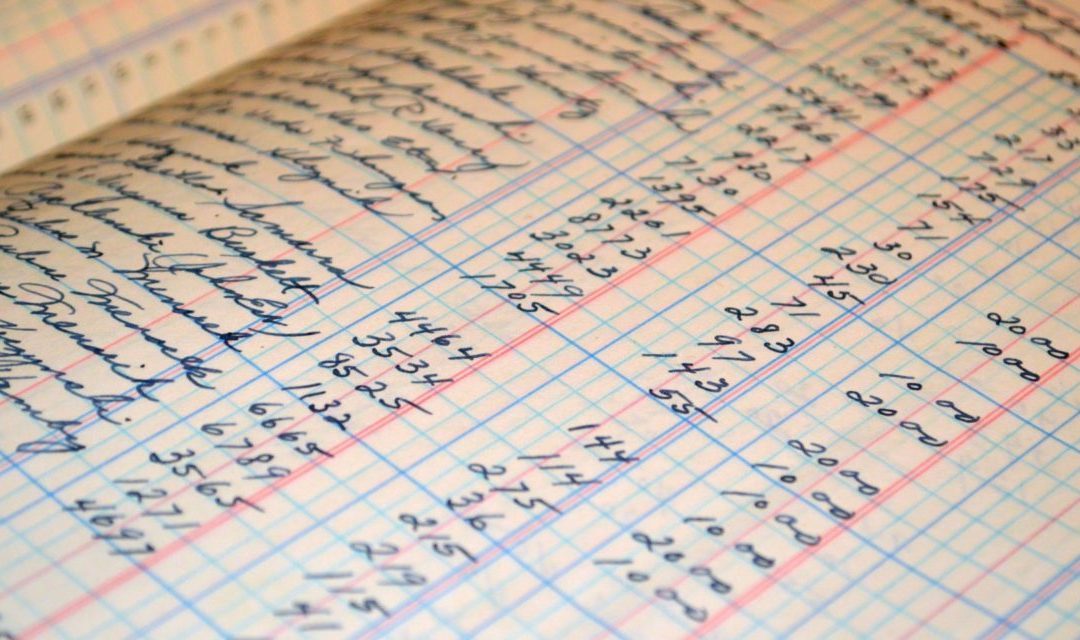

Okay, we’ve seen it’s possible for you to live beneath your means. Now we’re going to show you how to do it. Start by recording every single dollar you spend in the next month. Take a notebook with you, and write it all down. This is important because we want the information. We’ve already tracked your types of expenses in the past, and now we want to see how that affects your spending in the future. Writing your expenses down will keep you honest, and you’ll find you’re making wiser purchases as you move forward. Let this notebook serve as your confessional.

Extra Fragments:

6:46 – Essential, Non-Essential, And Waste.

13:50 – The Great Depression And Budgeting.

15:21 – goodbudget.com

Mailbag:

18:46 – Sarah is starting her first real job. She wants to know whether to take advantage of her employer’s Roth 401(k) or traditional 401(k) plan.

Puzzle Solver Assignment:

22:01 – Start recording your expenses. Carry a notebook with you, and start writing down everything you spend. This exercise will go a long way toward helping you create a budget.