Stocks Rise, Bonds Fall Amid Trade Optimism, Fed Pause

- Average economic growth, more mixed signals. Third-quarter data showed the U.S. economy grew at an average pace for the economic expansion, with signs of weakening in manufacturing.

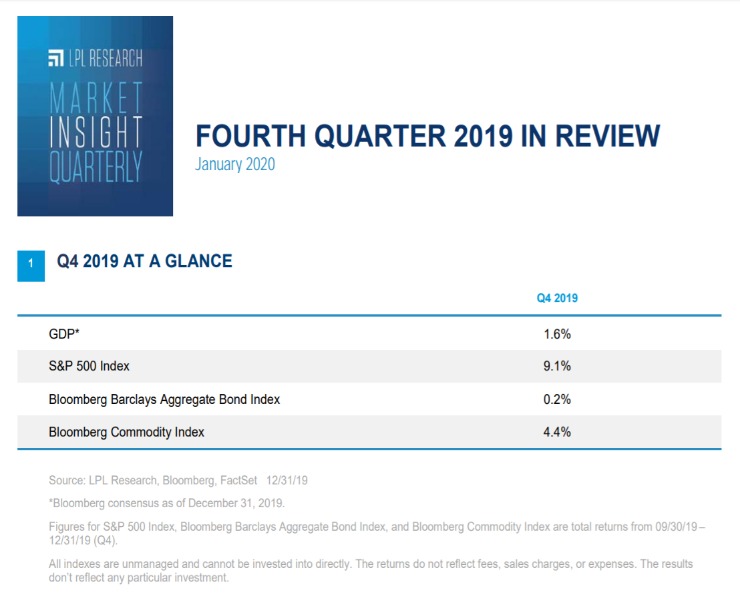

Gross domestic product (GDP) grew 2.1% quarter over quarter and 2.1% year over year in the third quarter. Consumer spending contributed 2.1 percentage points to the GDP increase during the quarter, while government spending added 0.3 percentage points. GDP likely climbed 2.2% in the fourth quarter, according to Bloomberg consensus estimates. Fourth quarter GDP data will be released January 30.

Gauges of manufacturing health slid during the third quarter as weakening demand weighed on production. Despite slowing growth, the U.S. job market continued to be a bright spot. Payrolls rose at an above-average pace for the expansion, and the unemployment rate hovered near multi-decade lows. In addition, wages grew at a healthy, manageable pace. Overall, leading indicators pointed to slowing growth, but low odds of a recession over the next 12 months.

The Federal Reserve (Fed) reduced interest rates by 25 basis points (0.25%) in October 2019. At that meeting, policymakers signaled a pause in rate cuts, which was confirmed when the Fed kept rates unchanged in December 2019.

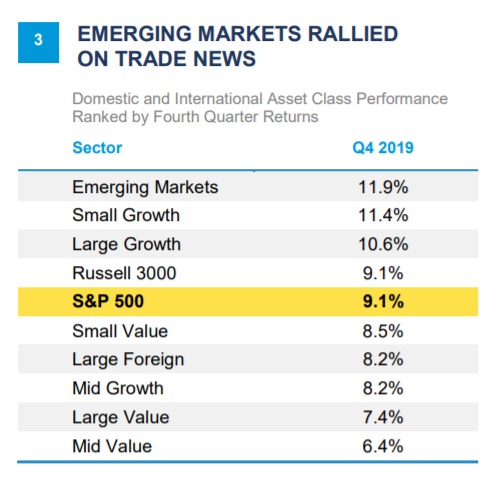

- Strong quarter for stocks. The Russell 3000 Index returned 9.1% during the fourth quarter, bringing its 2019 return to 31%, its best since 2013. Investor sentiment was buoyed by anticipation that the United States and China would strike a trade deal, which was confirmed in December, and signals from the Fed that it would hold rates steady for an extended period of time. Small cap stocks outperformed large caps, growth stocks beat value, and economically sensitive sectors—led by technology—outperformed high-dividend-paying defensive sectors. Growth leadership persisted throughout 2019 as technology was the year’s top sector performer. Globally, emerging market stocks outperformed U.S. and international-developed stocks during the fourth quarter based on the MSCI Emerging Markets, MSCI EAFE, and Russell 3000 indexes. Progress on U.S-China trade relations, a weaker U.S. dollar, and evidence of stabilizing global growth provided support for emerging markets, while lagging Japanese equities weighed on the developed international benchmark.

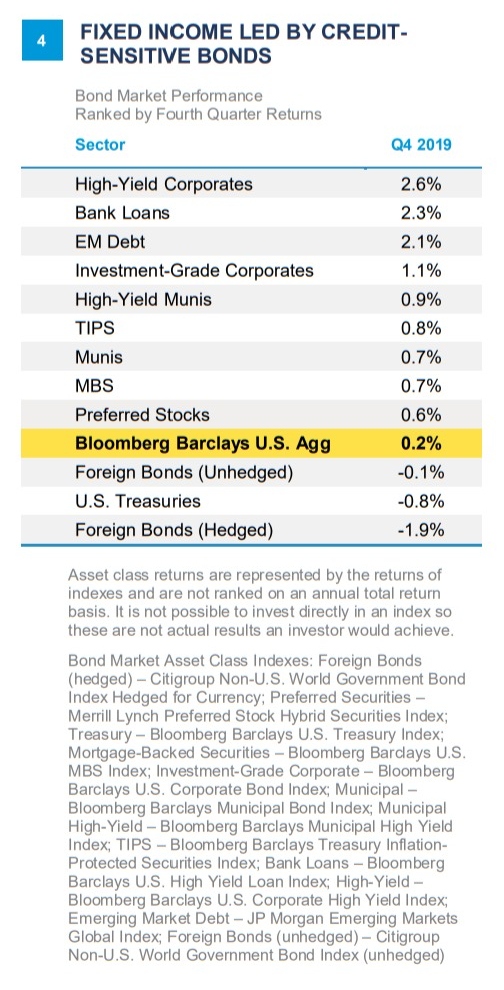

- Treasury yields bounced back. Fixed income prices remained largely unchanged during the quarter as a sell-off in U.S. Treasuries countered a rally in credit-sensitive debt. The Bloomberg Barclays U.S. Aggregate Index (Agg) returned 0.2% during the quarter as the 10-year Treasury yield climbed 25 basis points (0.25%) over the three months. The yield curve steepened as long-term yields rose faster than short-term yields. The spread between 10year and 2-year Treasury yields widened to an 18-month high during the quarter.

High-yield corporate debt gained 2.6% during the quarter to lead the major fixed income sectors we track. Bank loans climbed 2.3%. Treasuries fell 0.8%, and hedged foreign bonds slid 1.9%.

- Commodities rose. The Bloomberg Commodity Index finished the year strongly, gaining 4.4% in the fourth quarter and closing 2019 with a 7.7% annual return. Oil prices rose more than 13% during the quarter, benefiting from elevated Mideast tensions and an improving global growth outlook, bringing its 2019 advance to more than 30%. Natural gas prices fell sharply on warmer-than-expected fall weather to end 2019 down nearly 40%. Progress on trade and an improving global growth outlook boosted most industrial metals, as copper rallied 8% during the quarter to end the year 5% higher. Precious metals also produced solid quarterly gains as the U.S. dollar weakened notably, pushing gold and silver’s 2019 advances to 15.6% and 11.5%, respectively. Major agricultural prices rose late in the quarter on trade news but finished the year mixed. Commodity performance is based on the Bloomberg Commodity Index and its components.

- Event-driven strategies led gains. The HFRX Event Driven Index gained 5.6% during the fourth quarter as a rising equity market and tighter deal spreads supported portfolios. There was also a low failure rate among existing deals, which limited downside risks within portfolios. The HFRX Macro: Systematic Diversified Index was the main laggard (-2.0%), as a marginal increase in yields earlier in the quarter led to losses in long fixed income exposure. Currency trading was difficult, as sideways moves in the Canadian dollar and euro negatively impacted performance.

A Look Forward

We expect 1.75% U.S. GDP growth in 2020, as noted in our Outlook 2020: Bringing Markets Into Focus publication. Our forecast reflects the potential for continued trade uncertainty and weak business investment, but a steady consumer. Globally, Europe and Japan continue to struggle with trade uncertainty, geopolitical concerns, and sluggish growth. We anticipate more opportunities for growth in emerging markets’ economies.

Continued Fed flexibility should provide enough support to the economy to foster a modest increase in longer-term yields. Our year-end 2020 forecast for the 10-year U.S. Treasury yield is a range of 2–2.25%.

Better clarity on trade may help drive increased business spending and more productivity, which we think will lead to stronger earnings growth in the year ahead. We expect prospects for better earnings growth in 2020 to help support stocks at current valuations.

Our 2020 year-end fair value target range for the S&P 500 is 3,250–3,300, based on a trailing price-to earnings ratio (P/E) of 18.75 multiplied by our 2020 S&P 500 earnings per share (EPS) forecast of $175. We believe mild inflation and still low interest rates support these valuations. With stocks near the low end of our fair value range as 2020 began, we acknowledge that some 2020 returns may have been pulled forward into 2019, perhaps limiting the upside for 2020.

Finally, amid heightened geopolitical uncertainty, LPL Research will continue to focus on the fundamentals supporting GDP, inflation, employment, interest rates, and corporate profits when making investment decisions.

IMPORTANT DISCLOSURES

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. The economic forecasts set forth in this material may not develop as predicted. All performance referenced is historical and is no guarantee of future results.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

Tracking # 1-936848